It’s time for your money to hit the gym!

What a workout is to your body, investment is to your money.

Millions of millennials have taken to ensure a healthy lifestyle, and an equal or more have at least thought about improving their finances. What could be the reason for this?

The tandem of rising population and prices has called for the need for a reliable investment opportunity and a secondary source of income in addition to the long-established primary source of income.

But, amid a myriad of investment options at one’s disposal, which one should you be choosing?

Over the years, the financial landscape has transformed drastically, making investment one of the main sources of passive income for many. In recent times, plenty of individuals have leveraged real estate investments to build wealth.

Despite the industry taking time to pencil out returns, the extraordinary boon the sector saw during the first quarter of 2021 made it an attractive investment zone. Finance, insurance, real estate, rental, and the leasing group had the highest GDP contribution with approximately $7.7 trillion in output.

Sun Belt, the southern tier, has become a go-to place for many Americans in the United States due to its mild climate, affordable cost of living, and improved quality of life. The belt houses fifteen states and has experienced large migration, increased population, and economic activities over the years. Here are eight markets with great potential for real estate investments:

Coming back to the topic, how similar is exercising and investments?

They are like unidentical twins. Same but different.

Exercising builds long-term health Right investments create extended wealth

Working out boosts your long-term well-being but. Just moving your body has proven to yield the most significant longevity health benefits: flexibility, endurance, and mental health. Not immediately, but definitely.

Mirroring this, real estate investments have proven to create progressive wealth. How? Real estate values have a track record of sustained appreciation. One of the most common ways investors build wealth is when the value increases. The demand for land has surged over the years due to the population shooting up and has outstripped supply. This has assured a steady real estate ROI and has been a significant driver of the U.S. economy.

Exercise helps get rid of your health-related fears Real estate investment is your go-to inflation gear

Physical activity combats diseases and improves your quality of life. It considerably reduces the risk of ailments. An active person does not have to fret about serious health issues.

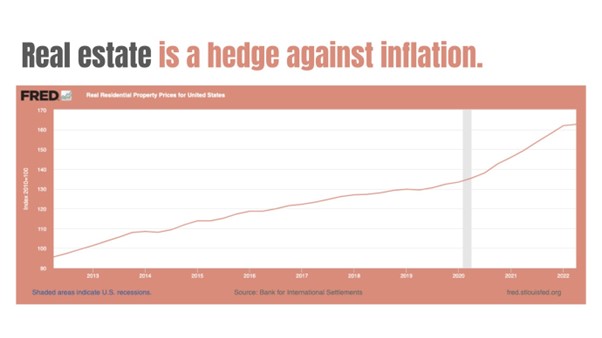

How is real estate investment similar to this? The rising prices are frowned upon because of two major consequences it brings along: rising costs and lowered purchasing power. However, real estate investing can be your hedge against inflation and your means to diversify your investment portfolio. In fact, inflation is a huge reason real estate creates wealth over time, thereby shielding you from its unfavorable side.

The inflation rate in December 2018 was 1.9% compared to the present rate of 8.2% in 2022. Imagine what the inflation rate would be ten years down the lane!

Source: FRED ECONOMIC DATA | St. LOUIS FED

A variety of exercises for your muscle flexes Duplexes, triplexes or fourplexes?

Working out does not just mean hitting the gym every day. Exercise could be cardio, strength training, zumba, yoga, and whatnot! Variety is key to having fun and being consistent.

Likewise, real estate does not just mean investing in land. There are various real estate property types to choose from – from residential houses, townhouses, multi-family properties, retail, office, and hotels to something as simple as land! Real estate offers a diverse range of opportunities to invest in. Adding to the list is the freedom of choosing your preferred location, stages of development, real estate classes, and more.

The real estate sector has had a steady momentum over the years and has proven to be a lucrative source of investment. Real estate investment is a great way to make returns without dramatically affecting your savings.

Though the world, especially the U.S., is on the brink of a possible recession, the real estate industry is usually well-positioned to weather the downturn. In a nutshell, despite slight turbulences, the pandemic-accelerated real estate boom is here to stay.

Ashton Gray Development is a vertically integrated real estate investment and development company that has created a competitive advantage that yields higher returns for its investors. With its proven 100% return on capital track record, Ashton Gray is a leader in the private equity real estate arena.

Are you looking to invest in U.S. property with a stellar return rate on your investments? You are just a click away!